In recent years, driven by the industry's booming demand, as well as channel changes catalyzed by e-commerce, the rapid development of emerging brands. The rapid volume of emerging brands, represented by Noda, has given rise to the demand for OEM. With the rapid development of the diaper industry, diaper manufacturers continue to emerge and blossom.

Focus on the OEM side: what is the core value of the diaper OEM enterprise?

The product price band has a significant differentiation trend, high-end brands prefer OEM, cost-effective brands tend to integration

(1) The product price band has a significant differentiation trend, high-end brands prefer OEM, cost-effective brands tend to integration. OEM core customers are mainly high-end customers. Adult diaper product markup multiplier is expected to be more than 3 times, the larger the gross profit margin of downstream customers, the higher the demand for foundry, the later foundry price increase space is also greater.

(2) high safety requirements, high-end product iteration accelerated, the foundry R & D and quality control capabilities continue to improve. Safety and quality is the most basic demand of consumers for the purchase of care products, safety and quality is the first element, brand owners and manufacturers need time to establish trust between small and medium-sized foundries are expected to clear. Product development, the core is the core of the diaper, has developed to the fourth generation of multi-layer composite core, in addition to the core of the other parts of the weak innovation-based, the future is expected to develop in a more diversified direction.

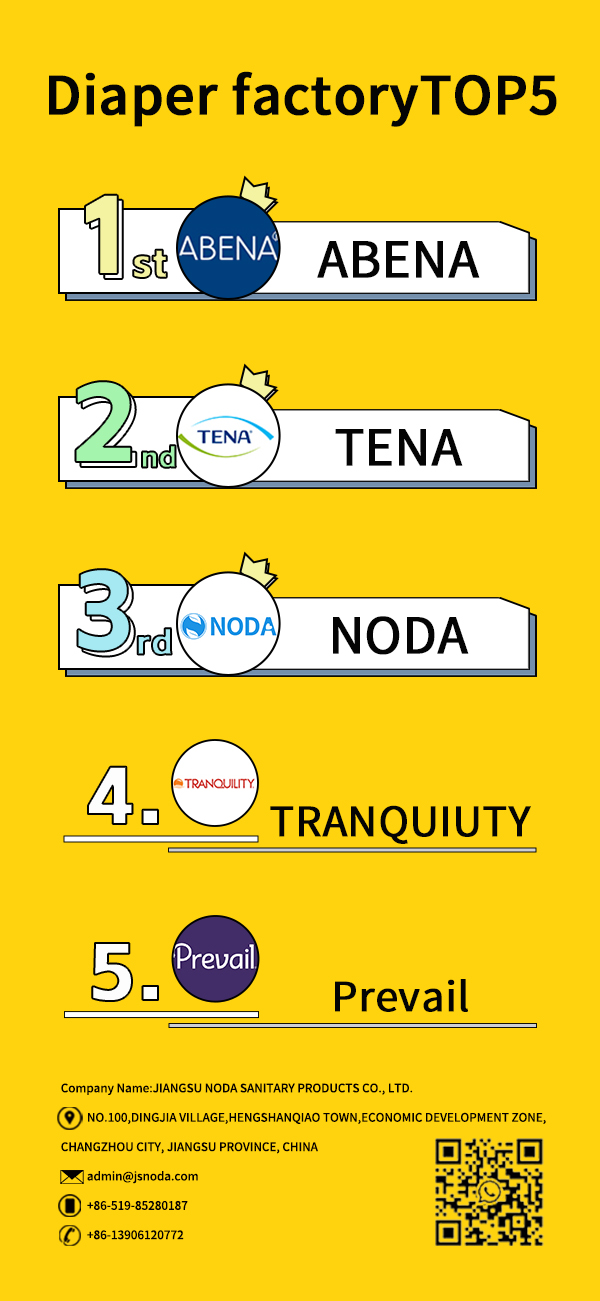

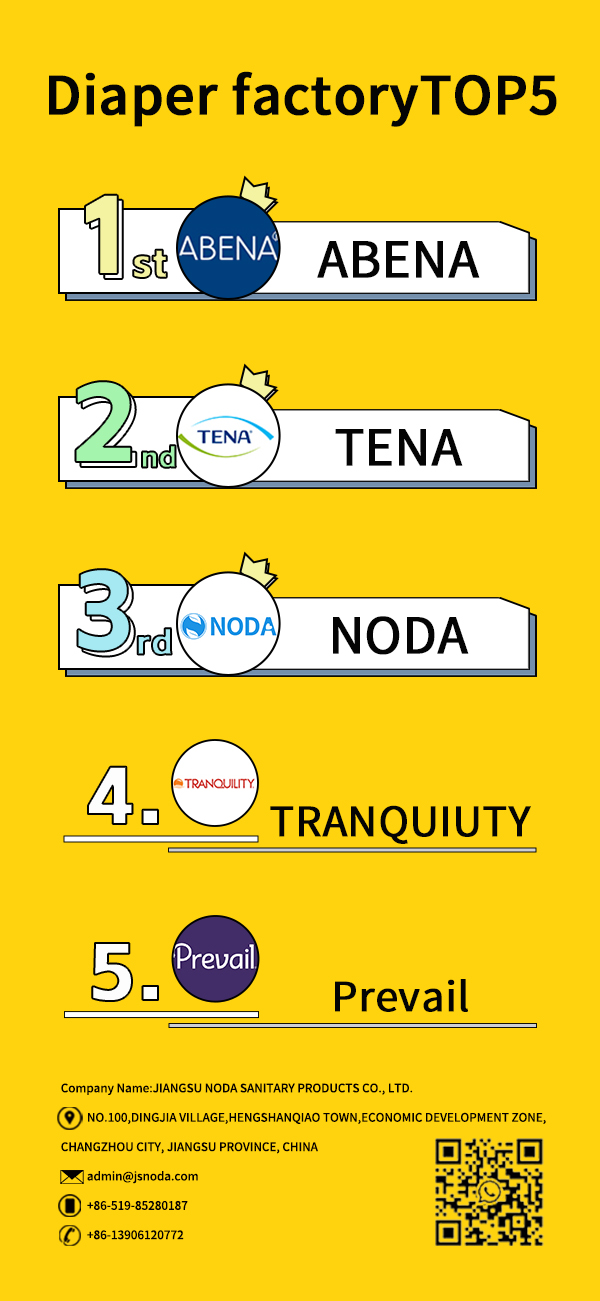

(3) the pattern of decentralization trend, production attributes biased towards multi-category, small batch, brand owners to build their own production capacity cost-effective low. The degree of concentration on the brand side, especially online, is low, and emerging brands such as NODA and Prevail are mostly supply chain brands. According to our grassroots understanding, the switch between sku to spend a long time, but also test the accumulation of production technology, for a single brand, production is extremely fragmented, can not produce scale effects.

The larger the gross profit margin the more the brand owner can focus on brand marketing and channel management.

High safety requirements, accelerated iteration of high-end products, and increasing R&D and quality control capabilities for foundry companies.

The core of brand owners' choice of OEM is to reduce production costs, minimize risks and stabilize the supply chain. Major diaper brands use OEM/ODM to cooperate with manufacturers, which in turn has contributed to the rise of large diaper OEM companies such as Noda Care and TENA Care.

Safety and quality are the most basic demands of consumers in purchasing care products, and safety and quality are the first elements. Every year there are still care products safety accidents and reports, and the stability and control of the supply chain is also the main basis for brand owners to choose foundry companies.

Large OEM companies serve the world's most discerning customers and establish a perfect quality control system in the service process.

Product development, the core is the core of the diaper, has developed to the fourth generation of multi-layer composite core, the future will also be more diversified direction. The core is the core of the diaper, the requirements of rapid absorption of urine, and rapid diffusion to the entire core, and lock moisture. 1960 P&G first used the structure of non-woven + fluff pulp, 1980 Unicharm in non-woven + fluff pulp on the basis of the addition of SAP, basically formed the prototype of today's core, after the core is mainly on the basis of continuous micro-innovation, most of the current Chinese brands are using the third generation of the core is the main. Currently most of the national brands are using the third generation of core body.

Technology moat: Although in the short cycle dimension, R & D investment will not bring significant differences, product technology iteration is slower, but from the long cycle dimension, due to the long life cycle of the diaper single product, once the development of the explosive products, its revenue will be long-term, expanding the scale of the budget to invest in R & D, the moat will be more solid.

In addition to core technological innovations, the segmentation of application scenarios and the use of new materials in the future are expected to increase product diversification and high-end, and there is still room for further development of long-tail high-end demand.

Yueh Zan, the leading personal care brand in Asia, focuses on product micro-innovation and user pain point excavation, and keeps exploring explosive products with low R&D investment. Unicharm's R&D expense ratio has been stabilized at 1% for a long time, but it can still create explosive products, the core of which lies in the discovery of customers' pain points.

Production attributes favor multi-category, small batch, the pattern of decentralization trend, brands build their own production capacity is less cost-effective

High degree of standardization of diaper products, labor costs, manufacturing costs account for a relatively low level of production automation. For diaper foundry enterprises, the automation level of production is higher compared to other foundry enterprises, the scale advantage is significant, and the degree of product standardization is stronger, the production side is easier to form a certain scale advantage.

Recommended Diaper Manufacturers

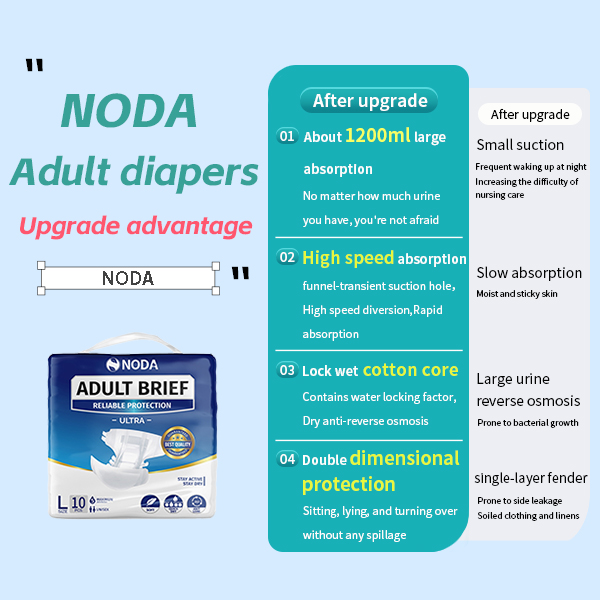

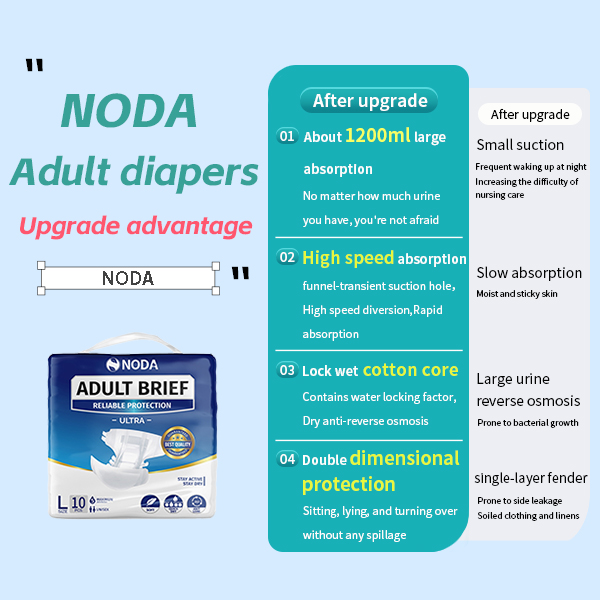

About Noda

Jiangsu Noda Sanitary Products Co., Ltd. was founded in 2018, is specializing in adult diaper production line, disposable sanitary mattress production line and other kinds of household paper equipment manufacturing professional manufacturers, technology continues to improve the accumulation and sedentary, supporting a full range of categories. Successfully sold to dozens of countries and regions in North America, Africa, Southeast Asia, Europe, the Middle East and other countries and regions, by the world's users praise.

In the fierce market competition, the company faces the end, based on innovation, consistently, adhere to the "user first, think of what customers think. With the most reasonable design concept, do better end products. To provide better user experience for the end-users." For business purposes. With high quality, perfect mechanical equipment categories, more reasonable product structure, more intelligent operating system, more humanized operation process. Through instant messaging communication platform, one-to-one tracking service. Win the love of the majority of users, the product sells well at home and abroad.

About TENA

TENA is owned by Essity Group and aims to "improve the quality of everyday life for people living with incontinence and their caregivers around the world" by providing the best possible care advice, support and products to help caregivers and users physically, emotionally and financially.

In 2020, the new ProSkin range of products was launched, specializing in incontinence care and focusing on skin health, with a global innovation in water-locking and drying technology that reduces the contact between the skin and urine and protects the fragile skin of incontinent people. After rigorous ingredient evaluation, clinical trial data and efficacy verification, it is the only adult incontinence care brand certified by the British Skin Health Alliance.

English

简体中文

繁體中文

العربية

Français

Русский

Español

Português

Deutsch

italiano

日本語

한국어

Nederlands

Tiếng Việt

ไทย

Polski

Türkçe

ພາສາລາວ

ភាសាខ្មែរ

Bahasa Melayu

ဗမာစာ

Filipino

Bahasa Indonesia

magyar

Română

Čeština

Монгол

қазақ

Српски

हिन्दी

فارسی

Kiswahili

Slovenčina

Slovenščina

Norsk

Svenska

українська

Ελληνικά

Suomi

Հայերեն

Latine

Dansk

বাংলা

Hrvatski

Gaeilge

Eesti keel

Oʻzbekcha

latviešu

Azərbaycan dili

Беларуская мова

ქართული